richmond county va business personal property tax

City Treasurer Armstead and Deputy Treasurer Morris. You have the option to pay by credit card or electronic check.

Tweet this Tangible property includes machinery and equipment furniture and fixtures of non-manufacturing businesses certain computer hardware trucks and automobiles and any other tangible property used in a business unless specifically exempted.

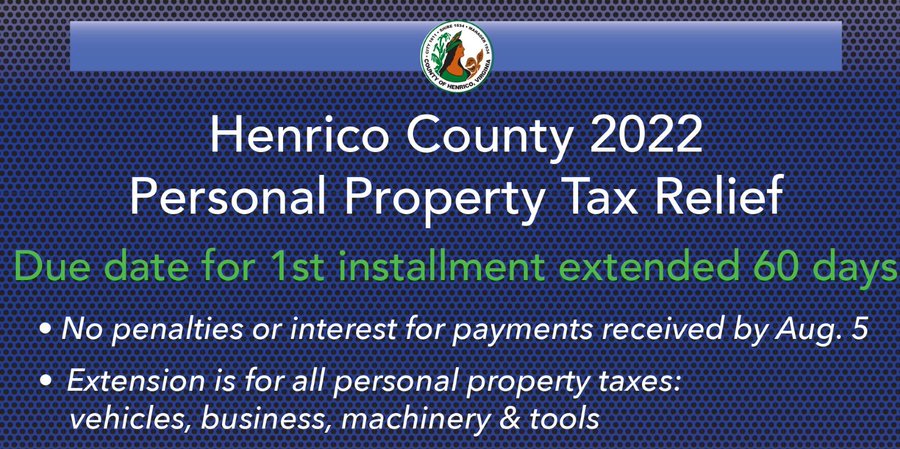

. You can make Personal Property and Real Estate Tax payments by phone. Personal Property taxes are billed annually with a due date of December 5 th. We do not accept form 762 as a complete filing for business personal property.

Application for Tax Relief for the Elderly and Disabled. The Commissioners Office uses a statutory assessment program for. July 1 September 30 50 of the full tax amount or 50 per 100 of net capital.

2022 Return of Business Tangible Personal Property Leased Equipment Schedule As required by Section 581-3518 of. Or corporation conducting business within Rockingham County as of January 1st of each year must file a tangible personal property assessment form by May 1st of each year. The median property tax in Richmond County Virginia is 673 per year for a home worth the median value of 148700.

Parking tickets can now be paid online. The Office of the Commissioner of the Revenue is available to assist you in any way possible. Application for Tax Relief for Disabled Veterans.

The total tax is 5 percent 4 percent state and 1 percent local A seller is subject to a sales tax on gross receipts derived from retail sales or leases of taxable tangible personal property. Personal Property Taxes. The 10 late payment penalty is applied December 6 th.

The business completes a Business Tangible Personal Property Tax Return including a fixed asset schedule and schedule of leased equipment and files the return with the City of Richmond on or before March 1 of each tax year. Our provided form must be used to constitute a complete filing. Upon receipt of the tax return the Department of Finance enters the data in the Citys Revenue Administration System and issues a tax bill to.

As of December 31 st of the year preceding the tax year for which assistance is requested the. Pay Your Parking Violation. PLEASE READ INSTRUCTIONS ON BACK BEFORE COMPLETING SECTIONS 12.

Commissioner of the Revenue. Click Here to Pay Parking Ticket Online. Business Personal Property Taxes are billed once a year with a.

If available in the property information you can also search by Intrument Number and Subdivision name. Assess individual and business personal property. For Personal Property Tax Payments Feel free to contact the office should you have any questions 804-333-3555.

Richmond County has one of the lowest median property tax rates in the country with only two thousand nine of the 3143 counties collecting a lower. Manufacturers do not pay tax on purchases used for production. Interest is assessed as of January 1 st at a rate of 10 per year.

Very truly yours William Page Johnson II. The property owner must be at least 65 years of age or determined to be permanently or totally disabled by December 31 st of the year preceding the year for which assistance in required. Business Personal Property Taxes are assessed to business owners on all business vehicles office equipment computer equipment farm equipment small tools fixtures furniture merchants capital and manufacturing machinery tools located in Richmond County as of January 1 st of each year.

Any person or company leasing equipment to a business or an individual in Rockingham County. Business Tangible Personal Property Tax Return2021 2pdf. Forty-five of Virginias 95 counties.

Business Personal Property. The Treasurers Offices mission is to treat all of its customers courteously and fairly while maintaining exceptional professionalism and. The vision of the Richmond City Treasurers Office is to resurrect a greater sense of purpose between the Richmond banking industry and the Central Virginia community at large by expanding the knowledge understanding and self-reliance of individuals and their personal finances.

YOU MUST COMPLETE THIS FORM IN ITS ENTIRETY. Distributors do not pay tax on items purchased for resale. Vehicle License Tax Antique.

On or before March 31 the full bank franchise tax is assessed or 1 per 100 of net capital. Only tangible business personal property is taxed. Application for Taxation on the Basis of a Land Use Assessmen t.

Vehicle License Tax Motorcycles. There is a convenience fee for these transactions. A business personal property return must be filed annually by May 1 for all business tangible personal property owned as of Jan.

Call 804 646-7000 or send an email to the Department of Finance. Richmond County collects on average 045 of a propertys assessed fair market value as property tax. The Commissioner of the Revenue and staff.

Form 760 - Resident Individual Income Tax Return. Maintain real estate owner information and county tax maps. If you have any questions regarding the operation of your business in the City or need assistance with filing this return please do not hesitate to contact me at 7033857880.

The Richmond County Treasurers Office bills and collects Real Estate and Personal Property taxes. TAX RELIEF FOR THE ELDERLY AND DISABLED - REAL ESTATE. Real Estate and Personal Property Taxes Online Payment.

Vehicle License Tax Vehicles. Parking Violations Online Payment. Car Tax Credit -PPTR.

THE CITY OF RICHMOND VIRGINIA ON JANUARY 1 2022 TO REPORT SUCH PROPERTY ON THIS RETURN. Schedule ADJ - Adjustments to Income. April 1 June 30 75 of the full tax amount or 75 per 100 of net capital.

Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. Other collections include dog registration fees building and zoning permit fees and state taxes. As stipulated in 581-3518 of the code of virginia it is the responsibility of every taxpayer who owns leases rents or borrows tangible personal property that was used or available for use in a business and which was located in the city of richmond virginia on january 1 2021 to report such property on this return.

Our primary goal is to serve the citizens of Richmond County in a fair and unbiased manner by providing the highest level of customer service integrity and fiscal responsibility. Business Tangible Personal Property Tax Return Richmond.

Virginia Dmv Extends Validity Of Licenses And Registrations

Gov Youngkin Signs Legislation Giving Parents More Control Over Child Education

Hamlet North Carolina Nc 28345 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Seven Startups Focused On Energy Related Businesses Chosen For First Dominion Energy Innovation Center Accelerator Business News Richmond Com

Among The Last In Virginia To Adapt Rappahannock Tentatively Introduces Gis Mapping Foothills Forum Rappnews Com

Office Of The Magistrate Henrico County Virginia

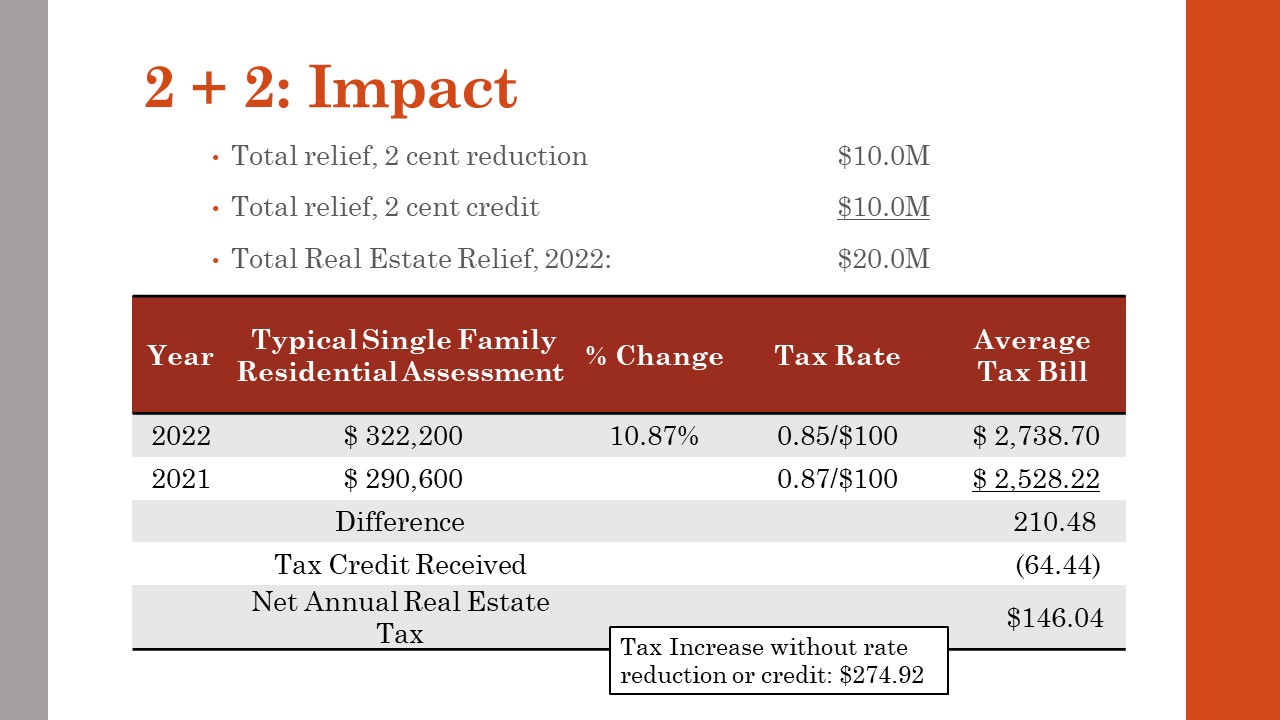

County Board To Reduce Real Estate Tax Rate Though Bills Will Still Go Up Ffxnow Fairfax County Va Local News

Richmond County Booking Highlights The Augusta Press

/cloudfront-us-east-1.images.arcpublishing.com/gray/PL7SOX426RGHRIK5FUEIA65UHY.jpg)

University Of Richmond Racist Photos In Yearbook Are Repulsive

Augusta Ga Richmond County Jail Mugshots

Hamlet North Carolina Nc 28345 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

.png)